Premium Executor Checklists & Tools

Australia's most used Executor Checklists & Tools with personal guidance & support

✓ Gain a complete overview and avoid missing important tasks

✓ Save time by handing over to simplyEstate or requesting support

✓ Be confident knowing you can access guidance and support any time

Who is the Premium Package for?

Suits Executors and Administrators who either want to engage a law-firm for the complete process or only the probate application and complete some administration tasks themselves. Be best prepared for the hand-over with your lawyer or tackle activities yourself in the most time-efficient way with support.

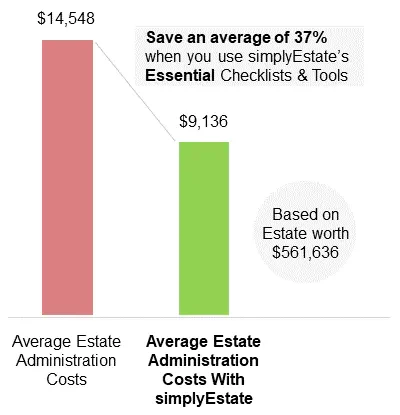

How You Can Save

Save an average of 37% of the total Deceased Estate administration costs using the simplyEstate Executor Checklists & Tools. Read more here.

What You Receive

Find more detail about all included Checklists & Tools to the right and below.

Find more detail about all included Checklists & Tools below.

Premium

$459 one-off

don’t pay $589 and save $130

- Complete Executor & Administrator Handbook (valued $29)

- Important Documents Checklist (valued $19)

- Home Contents & Personal Belongings Inventory (valued $19)

- Assets & Liabilities Inventory for Probate (valued $29)

- Beneficiary Inheritance Guide (valued $19)

- Estate Distribution Letter Template (valued $29)

- Testamentary Costs & Executor Expense Tracker (valued $19)

- Executor & Administrator Timesheet (valued $19)

- Letter of Authorisation – Banks & Financial Institutions (valued $19)

- Three hours of personal guidance and support (valued $390)1

Let us take some pressure off and save you valuable time.

Immediately save $900 in lawyer fees by being well informed and prepared.2

What Our Users Say

“If it weren’t for the essential checklists provided by simplyEstate I’m sure we would’ve spent a lot more time researching the internet for ages. The checklists are easy to use, to the point and really help you manage the estate. Thank you very much.”

Deb Williams

Joint Executrix – Newcastle NSW

“I was blown away by the tools and procedures provided here. I wish I had found this service sooner. I thoroughly recommend this website, the tools and service”

Isabella Leifi

Executrix – Melbourne VIC

“I can’t thank you enough for making the essential checklists available to provide a complete overview. I was trying to take it step by step but didn’t get ahead. Recommend the Essential Checklists to all executors, you won’t regret it.”

Greg Taylor

Executor – Sydney NSW

Compare Checklist & Tool Packages

How You Can Save

Reduce the Average Estate Administration Costs by 37%

Executors and Administrators who use the Essential Checklists & Tools save on average 37% of the total Estate management costs3.

Gain a solid overview of the process, be able to choose which administrative tasks to do yourself or outsource, and save time and fees by being fully prepared when engaging a lawyer for Probate application or the complete process.

Have a Question?

“Our mission is to empower Executors & Administrators to make Deceased Estate administration simple.”

Stephan Dahinden

Managing Director & Founder

Email us your question and we will help find the most suitable Checklists for you.

What You Receive

The Premium Checklists & Tools include our complete range of documents to assist you with managing the Estate administration process and hand-over to your lawyer with less effort and cost. Together with simplyEstate’s personalised support, you can hit the ground running.

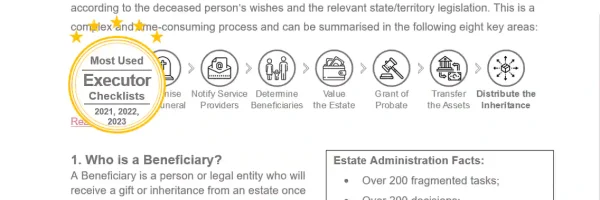

Complete Executor & Administrator Handbook

The Complete Executor and Administrator Handbook is the ultimate checklist and guide that every Executor needs. It summarises the 34 steps to successfully finalise and distribute a Deceased Estate, including key principles, pro tips and pitfalls to watch out for taken from learnings of over 3,500 Deceased Estates.

✔ Gain a complete overview

✔ Avoid timely & costly mistakes

✔ Distribute the Estate with confidence

Complete Executor & Administrator Handbook

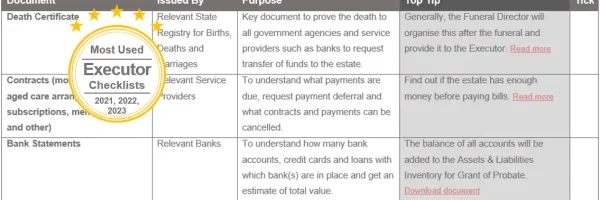

Important Documents Checklist

The Important Documents Checklist provides an overview of the most commonly used documents for Deceased Estate administration and what certified copies should be prepared by Executors and Administrators to save time.

✔ Know what key documents are needed

✔ Make certified copies to not lose originals

✔ Avoid additional trips to the Justice of the Peace

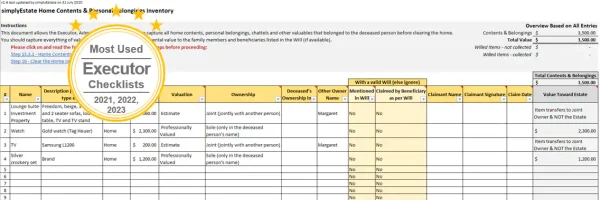

Home Contents & Personal Belongings Inventory

The Home Contents & Personal Belongings Inventory is a simple to use spreadsheet for Executors and Administrators to capture all the home contents and personal belongings of the deceased person before clearing the home and to keep track of willed items.

✔ Record valuables before removal

✔ Reduce disputes with Beneficiaries

✔ Keep track of gifts and bequests per the Will

Assets & Liabilities Inventory for Probate

The Assets & Liabilities Inventory is an automated Estate spreadsheet Executors use to capture everything belonging to a deceased person. Use this executor accounting spreadsheet to automatically determine what forms part of the Estate and calculate the total Estate value to apply for Probate.

✔ Record all assets and liabilities

✔ Key document to apply for Probate

✔ Automatically determine the Estate value

Beneficiary Inheritance Guide

The Beneficiary Inheritance Guide is a simple document that Executors and Administrators should provide to Beneficiaries to help them understand what Estate administration involves, what everyone’s roles are and what they can expect when nominated to inherit from an Estate.

✔ Build trust with Beneficiaries

✔ Avoid confusion and disputes

✔ Clarify what Beneficiaries can expect

Estate Distribution Letter to Beneficiaries Template

The Estate Distribution Letter to Beneficiaries template is a document that Executors and Administrators should complete and issue to all Beneficiaries to clearly communicate the Estate and inheritance details before finalisation and distribution.

✔ Explain the Estate composition

✔ Inform Beneficiaries of their inheritance

✔ Avoid disputes by requesting sign-off

Testamentary Costs & Executor Expense Tracker for Reimbursements

The Testamentary Costs & Executor Expense Tracker is a simple to use spreadsheet to assist Executors and Administrators track all costs and expenses relating to the Deceased Estate administration. It is used to seek and pay reimbursements once the Estate funds are available.

✔ Stay organised

✔ Keep track of all expenses

✔ Seek reimbursement from the Estate

Executor & Administrator Timesheet

The Executor & Administrator Timesheet is a simple to use spreadsheet to track time spent on Deceased Estate administration activities. It is used to seek adequate compensation for the Estate Administration duties where appropriate, before the residual Estate is distributed as inheritance.

✔ Stay organised

✔ Keep track of your time

✔ Seek commission from the Estate

Letter of Authorisation - Banks

The Letter of Authorisation is a simple to use document to assist Executors and Administrators provide authority to another person to act on their behalf with the nominated Bank or Financial Institution. If you are located far away or don’t have enough time, this will allow you to progress swiftly.

✔ Simple to complete and sign

✔ Major bank addresses included

✔ Authorise someone to act on your behalf

Personal Guidance & Support

simplyEstate will provide you with three hours of support of your choice1 when you need it. We can assist with preparing paperwork for hand-over to a lawyer or discussing your situation, a specific step, or how to approach a challenging situation. Let’s discuss your needs and how we can help during the first call.

✔ Fast-track with our support

✔ Discuss issues with an objective party

✔ Book times to suit your schedule

Premium

$459 one-off

don’t pay $589 and save $130

- Complete Executor & Administrator Handbook (valued $29)

- Important Documents Checklist (valued $19)

- Home Contents & Personal Belongings Inventory (valued $19)

- Assets & Liabilities Inventory for Probate (valued $29)

- Beneficiary Inheritance Guide (valued $19)

- Estate Distribution Letter Template (valued $29)

- Testamentary Costs & Executor Expense Tracker (valued $19)

- Executor & Administrator Timesheet (valued $19)

- Letter of Authorisation – Banks & Financial Institutions (valued $19)

- Three hours of personal guidance and support (valued $390)1

Let us take some pressure off and save you valuable time.

Immediately save $900 in lawyer fees by being well informed and prepared.2

Things you should know

1Personal guidance and support by simplyEstate will be provided via phone or email. Support can include administrative activities on behalf of the Executor but will not include provision of legal, tax, financial, or other specific advice as outlined in our Terms & Conditions.

2Lawyer fees saved is based on the time spent at $450 per hour to explain administrative aspects covered in these Checklists.

3Figures shown are for a Deceased Estate worth $561,636 (Australian average based on HSBC’s global Future of Retirement report) and costs include probate advertising, probate application, general legal advice, various administration costs, conveyancing of one property, tax advice and tax return preparation, and excludes funeral costs.

The Checklists & Tools on this page are not legal documents and do not constitute legal advice as per our Terms & Conditions.

Pay with confidence at simplyEstate – we use Stripe for secure payment processing.