Step 14 – Deceased Estate Administration Guide

Paying Deceased's Bills Before Probate (Solvent & Insolvent Estates)

- Last Updated: March 2024

This step explains everything you need to know about how to determine if you are dealing with a solvent or insolvent Estate, and if you should be paying the deceased's bills and other liabilities before probate. This step also answers questions like “Can you inherit debt in Australia?” and how you may choose to approach the payment of overdue bills and any other outgoings such as ongoing mortgage and loan repayments.

Overview

While you work through the Estate administration, you should always keep an eye out for mortgage payments, bills, credit card statements and other forms of debt payment notices. As the Executor or Administrator, you are ultimately responsible for paying from the Deceased Estate:- all mortgage and loan repayments;

- all bills and overdue bills;

- all taxes;

- all funeral expenses;

- all Estate administration related expenses; and

- all other debts and liabilities.

It is important to understand all types and amounts of debt that the deceased person had accumulated to ensure the Estate is administered accordingly without negative impacts for you nor the Beneficiaries. You should familiarise yourself in detail with each of the following.

Executor Checklists & Tools

Read More

14.1 General Considerations and When to Pay Debts

Until such time that you have fully administered the Estate and finalised the distribution, you as the Executor or Administrator are responsible for making sure the Estate is managed and all expenses and debts are paid.

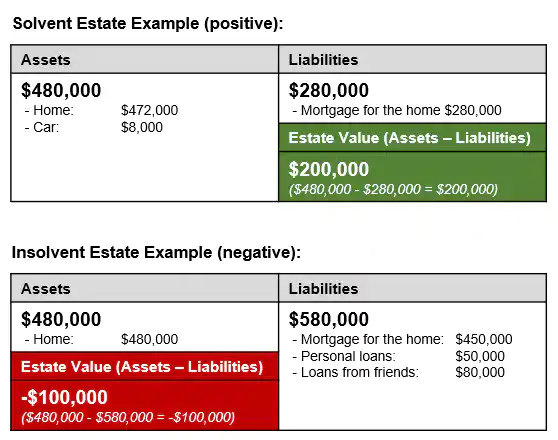

As the Executor or Administrator, one of the key tasks is to understand the total value of the Estate as you will be working through from Step 15 – Determining Deceased Estate Assets & the Residuary Estate. The Deceased Estate is made up of assets and liabilities (also referred to as debts). The Estate's value or equity is the remainder of all assets after all liabilities were paid. This means the Estate can either be solvent (the Estate has more money than it owes), or insolvent (the Estate has less money than it owes).

At this stage of the Estate administration process, it may be difficult to know if the Estate is solvent or insolvent. While the next few Steps of this Process Guide will explain how you access bank statements and all other financial information to determine the exact value of the Deceased Estate, you may already be able to assess if the Estate value is positive or negative. You should reach out to the Beneficiaries and Next of Kin to get an idea about the deceased person's estimated assets (cash, property, vehicles, other belongings etc.) and liabilities (mortgage, personal loans, credit card debt etc.) to help you estimate if you think the Estate is solvent (positive) or insolvent (negative).

It is important to note that the deceased person's debts held jointly or co-signed with another person or debts that were guaranteed by another person, may need to be partially repaid by the Deceased Estate or may transfer entirely to those other persons, hence may not form part of the Deceased Estate at all. You should seek legal advice if you are unsure.

Also, proceeds from a life insurance policy or superannuation benefits may not form part of the Estate and may also not be used to pay Estate debts, apart from funeral or Estate administration related expenses, depending on your state/territory legislation. These types of assets should be listed separately and is done in the simplyEstate Assets & Liabilities Inventory discussed in Step 15 – Determining Deceased Estate Assets & the Residuary Estate.

14.2 Solvent Estate – Decide to Pay Bills and Debts

If you are confident that the Estate is solvent by a good margin, meaning the total amount of assets is greater than the total amount of all liabilities (excluding superannuation and life insurance payments), then you as the Executor and Administrator will need to decide whether or not bills or debts should be paid immediately. Sometimes it is worthwhile contacting each organisation to which money is owed and request a grace period, while you work your way through the Deceased Estate to gain a better understanding. If you have notified all organisation of the death (as per Step 12), you may want to check directly if the notification was received and if payment is still required. Sometimes, you can also dispute a debt or charge if you believe it should no longer apply since the customer passed away.

If it is a smaller amount for services and products consumed such as electricity, water and phone you may consider paying these to avoid any interest payments, debt collection or services being terminated that someone may still depend on if living in a real estate that belongs to the Deceased Estate. However, any unused services should be cancelled immediately to avoid future payment requests.

Before paying any bills, it is worthwhile to discuss and negotiate a special arrangement with each Creditor (the company or person to whom money is owed) to either delay or not pay the debt at all depending on the agreement of the service or purchase.

Do not feel unreasonably pressured into paying until you have confirmed the terms of the agreement and are certain that the services or products were provided satisfactorily.

Where a mortgage, lease agreement or personal loan is in place, you should discuss repayments with the bank or lending institution as soon as possible to avoid additional fees or even the repossession and sale of the real estate or car. (see Step 14.4.1 – Secured Creditors below)

If you didn't notify all Government Departments, Companies and Organisations the deceased had dealings with yet, you can use the simplyNotify Tool to do so now and save time.

Each state/territory's legislation provides details about how debts are handled when an Estate is solvent as follows:

ADMINISTRATION ACT 1903 (WA) Section 10, Paragraph 5 (Austl.) (accessed 4/1/2021)

PROBATE AND ADMINISTRATION ACT 1898 (NSW) Section 82 (Austl.) (accessed 4/1/2021)

ADMINISTRATION AND PROBATE ACT 1958 (VIC) Sections 39A – 39B (Austl.) (accessed 4/1/2021)

SUCCESSION ACT 1981 (QLD) Section 59 (Austl.) (accessed 4/1/2021)

14.3 Insolvent Estate – Decide to Pay Bills and Debts

If you are confident that the Estate is insolvent, meaning the total amount of assets is smaller than the total amount of all liabilities, then you as the Executor and Administrator should not pay any debt immediately until you better understand and are able to confirm the degree of insolvency. You should inform the companies to which money is owed about the death, your presumption that the Deceased Estate is insolvent, acknowledge the bill or debt and explain that you are seeking legal advice.

It is recommended to hold off making any payments, read the legislation outlined below and seek legal advice immediately. As the Executor or Administrator, you may become liable for debts that should be paid before other types of debts and if not handled appropriately.As a general rule, all funeral expenses and costs relating to the administration of the Estate will always be given priority and paid before other Creditors (the company or person to whom money is owed).

While you get a better understanding of the degree of insolvency you should inform the Creditors of the death and agree to either delay or not pay the debt at all depending on the agreement of the service or purchase.

Do not feel unreasonably pressured to pay anything until you have confirmed with a lawyer what bills and debts should be paid and in which order. You will likely need to work through the next Steps to receive official values of all aspects of the Deceased Estate to ascertain that the Estate is insolvent.

If you didn't notify all Government Departments, Companies and Organisations the deceased had dealings with yet, you can use the simplyNotify Tool to do so now and save time.

The insolvent Deceased Estate may either be administered applying the FEDERAL BANKRUPTCY ACT 1966 (Cth) (Austl.) (accessed 4/1/2021) or based on each state/territory's legislation as follows stating the sequence in which debts are to be paid:

ADMINISTRATION ACT 1903 (WA) Schedule 5 (Austl.) (accessed 4/1/2021)

PROBATE AND ADMINISTRATION ACT 1898 (NSW) Schedule 3 (Austl.) (accessed 23/8/2023)

ADMINISTRATION AND PROBATE ACT 1958 (VIC) Section 39 (Austl.) (accessed 4/1/2021)

SUCCESSION ACT 1981 (QLD) Section 57 (Austl.) (accessed 4/1/2021)

14.4 What are Creditors

Creditors are legal entities or persons who provided money to the deceased person and to whom something is owed. Payments to Creditors should normally not be made until you have a complete picture of all the assets and liabilities that make up the Estate and hold a Grant of Probate or Letters of Administration issued to you by the Supreme Court (see Step 27 – Grant of Probate Application or Applying for Letters of Administration) in case the Estate is insolvent.

Using the simplyEstate Assets & Liabilities Inventory as discussed in Step 15 – Determining Deceased Estate Assets & the Residuary Estate will help you to determine and complete an overview of all the Estate's assets (cash, property, vehicles, belongings etc.) and all liabilities (mortgage, personal loans, credit card debt etc.). The result of these will then be the total amount of the Deceased Estate and will determine if all the debts can be paid or not.

14.4.1 Secured Creditors

Creditors can be classified as secured and unsecured. Secured creditors are the ones that hold an asset as a security against their liability such as a bank that provided a mortgage to the deceased person for a property with a certain market value. Secured Creditors can sell the secured asset to recover some of their debt and will mostly be paid out before Unsecured Creditors.

You should remember to discuss mortgage and loan repayments with the loaning bank or financial institution immediately to avoid late payment, interest and other fees or even a claim against the secured asset that may lead to foreclosure.

14.4.2 Unsecured Creditors

Unsecured creditors on the other hand lend you money without a collateral and do not have the ability to claim a secured asset by selling it to recover the debt. Unsecured creditors may end up not being paid if an Estate is insolvent.

14.4.3 How to Deal with Repayments

Oftentimes creditors such as banks will understand that the Estate administration takes time and are willing to wait for debt repayments. It is recommended to contact creditors as soon as possible to inform them of the death, provide your contact details and acknowledge the debts owed by the Estate so they have confidence that the debt will likely be repaid and who to contact.

14.5 Where to Pay From

If you decide to make payment(s) and the deceased person had bank accounts in joint names, that joint account holder retains full access to the accounts and could facilitate the payment(s) to cover bills, ongoing payments and paying debts during this process as agreed with you as the Executor or Administrator if there is no other funding source. Always keep track of all Estate administration related expenses as these will need to be tracked by you as Executor or Administrator.

If the deceased held all bank accounts in their sole name and cannot be accessed by you yet, it is common for the Executor, Administrator or Next of Kin to pay for bills, ongoing payments and paying debts from their own money. You, or the person making payment on behalf of the Deceased Estate, should have a high degree of confidence that the Deceased Estate is solvent, meaning the total value of all assets is larger than the total value of all liabilities.

Always keep account of all payments made by the Executor or Administrator during the administration process as you will need to claim the testamentary expenses back (see Step 31) once the full value of the Deceased Estate is understood and funds are available. You can download the Testamentary Costs & Executor Expense Tracker (part of the Essential Executor Checklists & Tools Package).

14.6 Pay Funeral and Estate Administration Related Expenses

All expenses related to the funeral and the Estate administration have priority and are to be paid as per the agreed due date. These costs should be paid prior to Estate distribution to Beneficiaries in Step 34 – Finalisation & Distribution of Estate to Beneficiaries.

If these expenses were paid by the Executor, Administrator or Next of Kin these should be recorded as these will be repaid once the Estate value is understood and access to the bank accounts to the Executor or Administrator are granted. You can download the Testamentary Costs & Executor Expense Tracker. This document is part of the Essential Executor Checklists & Tools Package.

14.7 Pay Mortgages and Personal Loans

If you decided to make payments for a solvent Estate, taking into account Steps 14.1 – 14.4 above, it is recommended to pay all secured debts such as mortgages and personal loan balances by the due date to avoid any negative impacts and incurring additional charges for the Estate. You may be able to discuss and negotiate a special arrangement such as lower repayments, deferral of payments, reduced interest or interest free repayments for a reasonable period while you work through the Deceased Estate administration.

It is important to note that payments into a bank account can always be made even if the accounts were put on hold or frozen, so you can continue to pay mortgage and loan repayments into the correct account to avoid penalties and late fees.

Step 19 – What Happens to a Bank Account When Someone Dies will explain these items in more detail.

14.8 Pay Bills

If you decided to pay bills for a solvent Estate, taking into account Steps 14.1 – 14.4 above, it is recommended to pay overdue and other bills so long as you are highly confident that the Deceased Estate is solvent and has money available to pay all the bills. You should try to negotiate a deferral or special arrangement with the Creditor or dispute the charge for a product or service that wasn't received or should no longer be provided. By having notified all Organisations known to you in Step 12 – Notification of Government Departments & Service Providers of the Death, you have informed the relevant Organisations and hence future bills may no longer need to be paid depending on the arrangement.

In many cases even if a fixed-term agreement was entered into by the deceased person, you will often be able to terminate a contract as a result of the death. Sometimes early exit fees or ongoing payments may still be required.

However, you should read the terms and conditions of the agreement the deceased had entered into by checking for any references about termination reasons and death of the person who entered into the agreement.

14.9 Pay and Cancel Credit Cards

If you decided to pay credit card debt for a solvent Estate, taking into account Steps 14.1 – 14.4 above, it is recommended to pay the remaining card balance of cards in the deceased person's name. You should cancel and destroy all main and secondary credit cards to be sure that they are no longer being used. Ensure you note down the credit card numbers in case you haven't provided these in Step 12 when you notified the relevant bank.

If a secondary card holder will need a credit card, they should apply for their own credit card as the main applicant. Where direct payments were set-up from those credit cards, as you can find out from the credit card statements, these will need to be changed as well to avoid negative impacts on the Estate.

Any credit card balances should be paid by the due date to avoid interest charges, which can be around 20% on the outstanding statement balance and any future payments until the balance is fully paid off as per terms and conditions.

Note: If the deceased person passed away whilst travelling and you will claim a death benefit from the travel insurance linked to a credit card in the deceased person's name, you should speak with the credit card provider before cancelling the account.Read Further

You are currently on Step 14 – Paying Deceased's Bills Before Probate (Solvent & Insolvent Estates). Other steps of interest may be:

< Step 7 – How To Organise A Funeral In Australia > Step 15 – Determining Deceased Estate Assets & the Residuary Estate > Step 27 – Grant of Probate Application or Applying for Letters of AdministrationComplete Step

Actions and Decisions to Complete Step Yourself

If you have decided to complete this Step yourself, some actions and decisions may be to:

- Determine if the Estate is solvent or insolvent (see Step 14.1 above);

- Review the types of bills, invoices, mortgage and loan repayments that are due and decide whether or not to pay (see Step 14.2 or Step 14.3 above);

- Contact the deceased person's bank to inform of the death and request that the funeral expenses be paid by the bank if possible (see Step 14.6 above);

- Contact the bank or financial institution to inform them of the death and request deferral for mortgage and loan payments (see Step 14.7);

- Contact other organisations to acknowledge the outstanding bill(s) and request for deferral until you better understand the Estate (see Step 14.8 above); and

- Record all expenses paid by you or other persons to seek reimbursement once you have full access to the Estate funds (download the Testamentary Costs & Executor Expense Tracker(part of the Essential Executor Checklists & Tools Package)).

Click for supporting:

Information

Forms

Legislation

Cost & Effort

Reading: 20 mins

Completing: 1-2 hrs

Total: 1:20-2:20 hrs

Cost: $0

Effort and cost are general estimates only and are based on the assumption that you complete this step without experienced support.

Instructions

To find out how this Process Guide works, access the instructions here.

Glossary

To find out what the capitalised words mean, access the glossary here.

Forms

N/A

N/A

N/A

N/A

Other forms not listed here may be required based on your specific circumstances.

Checklists & Tools

Download Australia's smartest Assets & Liabilities Inventory to automatically calculate the total Estate value based on ownership for probate.

Download Australia's most used Testamentary Costs & Executor Expense Tracker to keep track of all testamentary, funeral and administration expenses to seek reimbursement once all Estate funds are available. This document is part of the Essential Executor Checklists & Tools Package.

Legislation & Rules

Solvency

Solvent Estate in WA

ADMINISTRATION ACT 1903 (WA) Section 10, Paragraph 5 (Austl.) (accessed 4/1/2021)Insolvent Estate in WA

FEDERAL BANKRUPTCY ACT 1966 (Cth) (Austl.) (accessed 4/1/2021)ADMINISTRATION ACT 1903 (WA) Schedule 5 (Austl.) (accessed 4/1/2021)

Solvency

Solvent Estate in NSW

PROBATE AND ADMINISTRATION ACT 1898 (NSW) Section 82 (Austl.) (accessed 4/1/2021)Insolvent Estate in NSW

FEDERAL BANKRUPTCY ACT 1966 (Cth) (Austl.) (accessed 4/1/2021)PROBATE AND ADMINISTRATION ACT 1898 (NSW) Schedule 3 (Austl.) (accessed 23/8/2023)

Solvency

Solvent Estate in VIC

ADMINISTRATION AND PROBATE ACT 1958 (VIC) Sections 39A – 39B (Austl.) (accessed 4/1/2021)Insolvent Estate in VIC

FEDERAL BANKRUPTCY ACT 1966 (Cth) (Austl.) (accessed 4/1/2021)ADMINISTRATION AND PROBATE ACT 1958 (VIC) Section 39 (Austl.) (accessed 4/1/2021)

Solvency

Solvent Estate in QLD

SUCCESSION ACT 1981 (QLD) Section 59 (Austl.) (accessed 4/1/2021)Insolvent Estate in QLD

FEDERAL BANKRUPTCY ACT 1966 (Cth) (Austl.) (accessed 4/1/2021)SUCCESSION ACT 1981 (QLD) Section 57 (Austl.) (accessed 4/1/2021)

Other legislation and rules not listed here may apply to your specific circumstances.

Guidance & Support

Executor Checklists & Tools

Trusted Support

Have you encountered a challenge needing professional support, or are you unsure about how to proceed? Find out about our support options and personal guidance to get you back on your way with confidence.

Executor & Administrator Support WA

We can help with:- discussing this step in detail

- assessing your approach and best way forward

- engaging an Estate & Probate Lawyer

Review our services and book a free phone appointment.

Find Out More

Estate & Probate Lawyer WA

Our trusted partner can help with:- managing an insolvent Estate (bankruptcy)

- confirming if you should be paying deceased's bills before probate

- administering the Estate end-to-end

Executor & Administrator Support NSW

We can help with:- discussing this step in detail

- assessing your approach and best way forward

- engaging an Estate & Probate Lawyer

Review our services and book a free phone appointment.

Find Out More

Estate & Probate Lawyer NSW

Our trusted partner can help with:- managing an insolvent Estate (bankruptcy)

- confirming if you should be paying deceased's bills before probate

- administering the Estate end-to-end

Executor & Administrator Support VIC

We can help with:- discussing this step in detail

- assessing your approach and best way forward

- engaging an Estate & Probate Lawyer

Review our services and book a free phone appointment.

Find Out More

Estate & Probate Lawyer VIC

Our trusted partner can help with:- managing an insolvent Estate (bankruptcy)

- confirming if you should be paying deceased's bills before probate

- administering the Estate end-to-end

Request an obligation free phone call to discuss your situation.

Find Out MoreExecutor & Administrator Support QLD

We can help with:- discussing this step in detail

- assessing your approach and best way forward

- engaging an Estate & Probate Lawyer

Review our services and book a free phone appointment.

Find Out More

Estate & Probate Lawyer QLD

Our trusted partner can help with:- managing an insolvent Estate (bankruptcy)

- confirming if you should be paying deceased's bills before probate

- administering the Estate end-to-end

Request an obligation free phone call to discuss your situation.

Find Out More