Simple Executor Checklists & Tools

Save $1000s with Australia's most used Probate Checklists for Executors and Administrators

✓ Gain complete overview & step-by-step instructions

✓ Avoid missing crucial tasks & costly mistakes

✓ Finalise & distribute the Estate with confidence

We understand that the Deceased Estate administration process can seem daunting and unclear at first, especially during this difficult time. Rest assured our proven Executor Checklists & Tools are suitable for all situations and requirements.

Featured In

Find Your Suitable Checklists & Tools

by answering a few simple questions.

What Our Users Say

“I wish I’d found Simply Estate much earlier : the information on the site would have helped me ask the right questions of lawyers and saved some of the stress in administering a friend’s estate . The templates and checklists are easy to understand and indicate where there are differences between states.”

Katherine Capper

Executrix – Brisbane QLD

“I can’t thank you enough for making these essential checklists available. I was trying to take it step by step but didn’t get ahead. Recommend the checklists to all executors, you won’t regret it.”

Greg Taylor

Executor – Sydney NSW

“I was blown away by the tools and procedures provided here. I wish I had found this service sooner. I thoroughly recommend this website, the tools and service”

Isabella Leifi

Executrix – Melbourne VIC

Executor Checklist & Tool Packages

Light

$49 one-off

don’t pay $67 and save $18

Suits Executors and Administrators who aren’t sure about the process and their approach yet and want to find out how to get started.

What you receive:

3 Checklists & Tools

Essential

$99 one-off

don’t pay $199 and save $100

Suits Executors and Administrators who want to navigate the process confidently to successfully finalise and distribute the Estate.

What you receive:

9 Checklists & Tools

Premium

$459 one-off

don’t pay $589 and save $130

Suits Executors and Administrators who value guidance and support to progress the Deceased Estate administration.

What you receive:

9 Checklists & Tools +

3 Hours of personal guidance & support1

Compare Packages

| Light |

Essential |

Premium |

|

|---|---|---|---|

| Gain clarity about the process and approaches | ✓ | ✓ | ✓ |

| Find out what important documents you will need | ✓ | ✓ | ✓ |

| Record valuables before they're taken by Beneficairies | ✓ | ✓ | ✓ |

| Automatically calculate the Estate value for Probate | ✓ | ✓ | |

| Inform Beneficiaries of the process and their role | ✓ | ✓ | |

| Communicate inheritances and request sign-off | ✓ | ✓ | |

| Track costs to seek reimbursement from Estate | ✓ | ✓ | |

| Track time spent to seek commission from Estate | ✓ | ✓ | |

| Delegate your Executor authority when you need assistance | ✓ | ✓ | |

| Personal Guidance & Administration Support from simplyEstate | ✓ | ||

| Total | $49 |

$99 |

$459 |

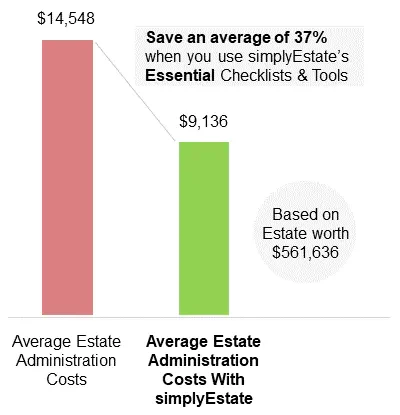

How You Can Save

Reduce the Average Estate Administration Costs by 37%

Executors and Administrators who use the Essential Checklists & Tools save thousands of the total Estate management costs2.

Gain a solid overview of the process, be able to choose which administrative tasks to do yourself or outsource, and save time and fees by being fully prepared when engaging a lawyer for Probate application or the complete process.

Have a Question?

“Our mission is to empower Executors & Administrators to make Deceased Estate administration simple.”

Stephan Dahinden

Managing Director & Founder

Email us your question and we will help find the most suitable Checklists for you.

Individual Checklists & Tools

If you are en experienced Executor or Administrator and know exactly which documents you’re after, you can purchase these individually. If you aren’t quite sure, we highly recommend buying the Essential Package, which was carefully put together for best value knowing that all Executors will need most if not all of those Checklists & Tools.

Complete Executor & Administrator Handbook

The simplyEstate Complete Executor and Administrator Handbook is the ultimate checklist and guide that every Executor needs. It summarises the 34 steps to successfully finalise and distribute a Deceased Estate, including key principles, pro tips and pitfalls to watch out for taken from learnings of over 3,500 Deceased Estates.

✔ Gain a complete overview

✔ Avoid timely & costly mistakes

✔ Distribute the Estate with confidence

Assets & Liabilities Inventory for Probate

The simplyEstate Assets & Liabilities Inventory is a simple estate spreadsheet Executors use to capture everything belonging to a deceased person. Use this executor accounting spreadsheet to automatically determine what forms part of the Estate and calculate the total Estate value to apply for Probate.

✔ Record all assets and liabilities

✔ Key document to apply for Probate

✔ Automatically determine the Estate value

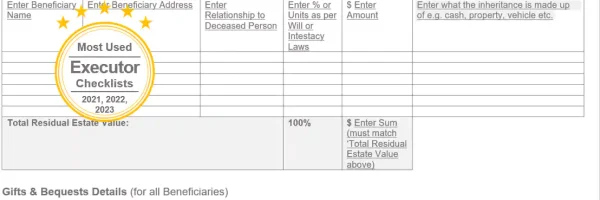

Estate Distribution Letter Template

The simplyEstate Estate Distribution Letter to Beneficiaries is a document that Executors and Administrators can complete to issue a letter to communicate the estate and inheritance details before distribution of the estate to beneficiaries.

✔ Explain the Estate composition

✔ Inform Beneficiaries of their inheritance

✔ Avoid disputes by requesting sign-off

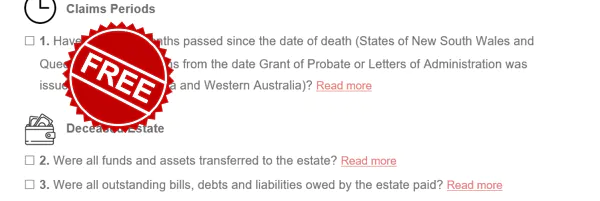

Free Executor & Administrator Handbook Summary

The free simplyEstate Executor & Administrator Guide is a practical summary of the Complete Executor & Administrator Handbook providing an overview of all steps needed to successfully administer, finalise and distribute a Deceased Estate in Australia.

✔ Gain an overview

✔ Avoid missing anything

✔ Help find out your approach

Free Download

Please provide your details to receive the Free Executor Handbook Summary via email straight away.

Download & Get Started Right Away

Light

$49 one-off

don’t pay $67 and save $18

Suits Executors and Administrators who aren’t sure about the process and their approach yet and want to find out how to get started.

What you receive:

3 Checklists & Tools

Essential

$99 one-off

don’t pay $199 and save $100

Suits Executors and Administrators who want to navigate the process confidently to successfully finalise and distribute the Estate.

What you receive:

9 Checklists & Tools

Premium

$459 one-off

don’t pay $589 and save $130

Suits Executors and Administrators who value guidance and support to progress the Deceased Estate administration.

What you receive:

9 Checklists & Tools +

3 Hours of personal guidance & support1

Things you should know

1Personal guidance and support provided by simplyEstate will be via phone or email. Support can include administrative activities on behalf of the Executor but will not include providing legal, tax, financial, or any other specific advice as outlined in our Terms & Conditions. Any costs to third-party providers, organisations and government agencies associated with activities completed by simplyEstate are not included in this price and will be on-charged in full.

2Figures shown are for a Deceased Estate worth $561,636 (Australian average based on HSBC’s global Future of Retirement report) and costs include probate advertising, probate application, general legal advice, various administration costs, conveyancing of one property, tax advice and tax return preparation, and excludes funeral costs.

The Checklists & Tools on this page are not legal documents and do not constitute legal advice as per our Terms & Conditions.

Pay with confidence at simplyEstate – we use Stripe for secure payment processing.