Deceased Estate Administration - Complete Overview

✓ Avoid missing crucial tasks

✓ Learn about all the steps

✓ Find out your approach

What Does Deceased Estate Administration Involve?

Deceased Estate Administration comprises a complex set of tasks the designated Executor (or Administrator) must fulfill. Upon the Testator’s death, you’ll be responsible for identifying assets, paying off debts and taxes, and distributing the remaining assets to the Beneficiaries according to the Will or the laws of intestacy.

As a practical and legal process, Deceased Estate Administration requires meticulous attention to detail, patience, dedication, honesty, and adherence to the law.

Deceased Estate – Meaning

What is the meaning of ‘Deceased Estate’?

Simply put, a Deceased Estate encompasses all the collective assets and liabilities left by an individual after death, including properties, investments, debts, and more. During the administration of the Estate, these are subjected to a legal process for distribution among the heirs or Beneficiaries.

States We Operate In

simplyEstate’s goal is to provide the information and guidance you need to proceed confidently as an Executor or Administrator, and to simplify the myriad tasks that can sometimes become overwhelming. We have been assisting Executors (and Administrators) in administering Deceased Estates in New South Wales, Victoria, Western Australia and Queensland.

What Our Users Say

“Losing a loved one is emotionally very difficult. Being faced shortly after with another difficult task as Executor can be overwhelming, especially if the estate is complex. Having the simplyEstate guidelines at hand made the task much easier to navigate with confidence and accuracy.”

Anthony Frizza

Melbourne VIC

“By far the most comprehensive guide to navigating the Steps that need to be taken after the loss of a Loved one. You won’t find this information anywhere, even on Government websites which is where it should be.”

Ben Jones

Perth WA

“This online guide and the affordable tools were invaluable. They really helped me understand what needed to be done. They gave me the confidence to act as Joint Executor. The Beneficiaries were given a clear overview of my late mother’s estate value. I found using the assets and liabilities spreadsheet easy and intuitive.”

Chris Quinn

Townsville QLD

Deceased Estate Administration Overview

The Executor or Administrator is responsible for the Deceased Estate Administration process, which involves over 200 tasks and decisions. Use our online and downloadable Executor Guides, Checklists and Tools to finalise and distribute the Deceased Estate with less effort. Our guide contains step-by-step instructions for a seamless Estate Administration process—something you won’t find on any other website in Australia.

Where to Start

Answer a few questions to find out where you should start.

How to Administer a Deceased Estate

You may not have a checklist on what to do after a death occurs or know the answer to the question: How long does it take to finalise a Deceased Estate? But we’re here to help. At simplyEstate, we’ve made it our mission to make the Deceased Estate administration process as simple, affordable and accessible as possible.

A Deceased Estate can be dealt with in many ways. Depending on your situation and preference, you can choose from one of the following approaches that best suits you.

What is Your Approach?

Hands-On

Use Our Free Executor Guide

250 Hours of Executor Time*

Lowest Cost

You want to administer the Deceased Estate yourself in honour of the deceased person.

Supported

Use Our Executor Support

Save 90 Hours of Executor Time*

Low Cost

You want to complete the Estate Administration yourself with ad-hoc support.

Hands-Off

Use an Estate & Probate Lawyer

Save 220 Hours of Executor Time*

Higher Cost

You want to hand everything over and only get involved when absolutely necessary.

*The cost and time savings for Executors or Administrators to administer a Deceased Estate are indicative only and vary depending on the size and complexity of each Deceased Estate including but not limited to the number of Beneficiaries, asset structure, number of property and family structure. The times assume a simple Estate and exclude legal disputes and litigation.

Find Out Your Approach

Answer a few questions to find out your suitable approach.

Executor Guidance & Support

Administration

Overview

Free Overview

simplyEstate’s Executor Handbook Summary provides Executors and Administrators complete overview of the Deceased Estate administration process.

Checklists

& Tools

Free to $589

simplyEstate’s Executor Checklists & Tools guide and prompt you while working through the Estate administration. Review all and only pay for the ones you need.

Executor & Administrator Support

First Phone Appointment Free

simplyEstate’s Executor & Administrator Support allows you to discuss your approach, next steps and how to best engage a specialist i.e. Estate Lawyer.

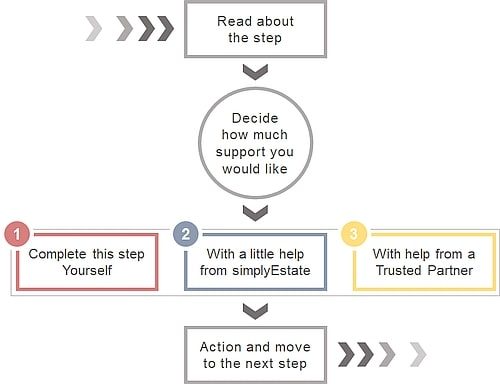

How Our Administration Guide Works

The online Deceased Estate Administration Guide allows you to work through the deceased estate administration process in a structured way, in your own time and at your chosen pace.

You have full control and decide at each step how much you want to do yourself, how much support you may want from us or from one of our carefully selected Trusted Partners across Australia, near you.