Step 20 – Deceased Estate Administration Guide

Dealing With Businesses, Trusts & Shares After a Death

- Last Updated: March 2024

This step's objective is to help you determine what options are available where the deceased person owned a business, had shareholdings or held key roles in a business. You may want to appoint yourself as the Executor as the interim business owner until the Estate is fully administered or hand-over the operation to someone.

Overview

If the deceased person had their own business, held shares of businesses, had a trust or held positions on boards of companies you will need to:- determine all business and other dealings the deceased person had;

- inform those businesses of the death;

- understand the extent to which the deceased person was involved in those businesses; and

- put in place the necessary measures.

Executor Checklists & Tools

Read More

20.1 Types of Business Structures

20.1.1 Sole Trader

An individual who operates a business under their own name and are personally liable for all aspects of the business. Staff can be employed, and the income generated from such a business is treated as personal income of the owner.

20.1.2 Company

A separate legal entity that has shareholders and Directors. Staff can be employed, and the income generated from such a business is treated as business income.

20.1.3 Partnership

A group of people or entities who join forces to run a business together. They are jointly and individually responsible and liable for all aspects of the business. Staff can be employed, and the income generated from such a business is treated as personal income by each partner.

20.1.4 Trust

A separate legal entity that has a trustee who manages the trust and distributes the trust's proceeds to the Beneficiaries.

Note: Step 29 – Opening a Testamentary Trust per the Will explains in detail how to set-up a trust for the purposes of managing the Deceased Estate assets.

20.2 Role of the Deceased Person

There are numerous ways a person may have been involved or been part of business activities. A person may have multiple such roles with the same or different companies as well.

20.2.1 Shareholder and Business Owner20.2.2 Business Manager

20.2.3 Board Member

20.2.4 Partner

20.2.5 Trustee or Trust Beneficiary

20.2.6 Signatory

20.2.1 Shareholder and Business Owner

The deceased person may have been a shareholder of a public or private company such as a Proprietary Limited or Limited company. A shareholder is also often referred to as member or owner of a company.

The main document that proves a person's ownership of parts or an entire business is a share certificate.

For publicly listed companies that are listed on the Australian Stock Exchange (ASX), the deceased person has either had to invest using a trading company, investment fund or used an investment account to trade shares themselves. You should be able to find documents in relation to the investments or statements showing the value of the investments. It is critical to attain the total value of the holdings.

For private companies such as a Proprietary Limited (Pty Ltd), Limited (Ltd) or Partnership you can order a share certificate for a fee from the Australian Securities and Investment Commission (ASIC).

Strict rules apply to Owners and Directors of companies including accurate record keeping, lodging quarterly Business Activity Statements (BAS), paying annual review fees to the Australian Securities and Investments Commission (ASIC) and submitting annual tax returns to the Australian Taxation Office (ATO). You should inform yourself about who takes care of these activities if the deceased person owned a business or other legal entity.

The total value of the investments can be added to the simplyEstate Assets & Liabilities Inventory by the Executor, Administrator or Next of Kin if not already covered through the bank accounts as outlined in Step 19 – What Happens to a Bank Account When Someone Dies.

20.2.2 Business Manager

The deceased person may have been managing the day-to-day operation of their own or someone else's business. They may have called themselves director, managing director, Chief Executive Officer or another title. It is important to look for emails or documents that state the business name and check what title was used to help determine who to notify of the death to ensure that any responsibilities and duties will be taken care of in the deceased person's absence. In such positions it is common to being paid or incentivised with share plans that may form part of the Deceased Estate.

20.2.3 Board Member

The deceased person may have been a member of one or more boards. Often boards exist in companies, clubs and strata (apartment buildings or townhouses) and the three key positions are those of the Chairman, Secretary and Treasurer.

It could be that the deceased person held one of these roles on a board and you can inform the board of the death, so the remaining board members can take the necessary steps as governed by their constitution, by-laws or other rules.

20.2.4 Partner

The deceased person may have been a partner to a partnership, commonly in professional services such as law and accounting.

The other partners will need to be informed of the death, so that the necessary steps can be taken as per the partnership agreement if one is in place.

Where no partnership agreement is in place and depending on your state/territory, the following applies:

If no partnership agreement is in place between the partners, the partnership dissolves with effect from the date of the death or bankruptcy.

Relevant Legislation PARTNERSHIP ACT 1895 (WA) Section 44 (Austl.) (accessed 4/1/2021)If no partnership agreement is in place between the partners, the partnership dissolves with effect from the date of the death or bankruptcy.

Supreme Court of NSW PARTNERSHIP ACT 1892 (NSW) Section 33 (Austl.) (accessed 4/1/2021)If no partnership agreement is in place between the partners, the partnership dissolves with effect from the date of the death or bankruptcy.

Supreme Court of VIC PARTNERSHIP ACT 1958 (VIC) Section 37 (Austl.) (accessed 4/1/2021)If no partnership agreement is in place between the partners, the partnership dissolves with effect from the date of the death or bankruptcy.

Relevant Legislation PARTNERSHIP ACT 1891 (QLD) Section 36 (Austl.) (accessed 4/1/2021)20.2.5 Trustee or Trust Beneficiary

The deceased person may have been a trustee (owner) or a Beneficiary (a person who benefits from the trust in form of income) of a trust. The Executor, Administrator or Next of Kin should inform the owner of the trust and the other trustees, if applicable, or the beneficiaries of the trust of the death. This will allow the necessary persons to take the actions needed to resolve the issues surrounding the death and how the trust continues to operate moving forward.

20.2.6 Signatory

The deceased person may have been a signatory to a company, club or trust bank account. If the relevant company, club or trust has other signatories these should be informed so that a new signatory can be appointed and deal with the relevant bank or financial institution.

20.3 Constitution, Partnership Agreements, Shareholder Agreements and By-Laws

In the cases listed above it is advisable to request a copy of the governing documents such as the company constitution, partnership agreement, shareholder agreement and by-laws or other forms of rules and contracts. This will allow you to familiarise yourself as an Executor, Administrator or Next of Kin with any administrative work that is required of you, what type of work may need to be continued or how to cease operation altogether.

20.4 Company Assets and Liabilities

20.4.2 Sole Trader

20.4.3 Company

20.4.4 Partnership

20.4.5 Trust

20.4.1 Overview

You should note that company, partnership and trust assets and liabilities may form part of the Estate depending on the legal structure. It is important to remember that sole traders and partners generally are fully liable for any debts, which may be accessed from the Deceased Estate. The decision to continue the business, transfer its shares to beneficiaries or to wind-up the business should only be made after seeking appropriate advice.

20.4.2 Sole Trader

As a sole trader, all assets and liabilities of the company form part of the deceased person's Estate. This means that everything forms part of the Estate and needs to be included in your Assets & Liabilities Inventory.

20.4.3 Company

Assets and liabilities of a company belong to the company. However, the deceased person may have full or partial ownership of that company and hence parts of the assets and liabilities may fall within the Estate. The portion of company assets owned by the deceased person should be listed in your Assets & Liabilities Inventory.

20.4.4 Partnership

Assets and liabilities of a partnership belong to the partners equally or as agreed in the partnership agreement. Some assets and liabilities of the partnership may fall within the Deceased Estate and should be in included in your Assets & Liabilities Inventory.

20.4.5 Trust

Depending on the agreement, some assets and liabilities form part of the Deceased Estate and should be listed in your Assets & Liabilities Inventory.

There may also be future income distribution to the deceased person and those may need to be noted as these may be redirected to Beneficiaries of the Deceased Estate.

20.5 Continuing the Business Through Succession

If the deceased person was the owner of the business and was also the sole owner and sole director, then the Executor or Administrator may appoint a new director. This can be done before all shares are transferred to the beneficiaries of the Deceased Estate, who then appoint a new director, to ensure the business can continue to run during the Deceased Estate administration process.

Relevant LegislationCORPORATIONS ACT 2001 (Cth) Section 201F (Austl.) (accessed 4/1/2021)

If the deceased person was not the only owner or director of the company, then the remaining owners and directors can take the necessary steps to maintain the ongoing operation of the business. The shares of the deceased person may transfer to the Beneficiaries as part of the Deceased Estate administration process.

The Executor or Administrator will be able to elect to be the holder of the shares or transfer the shares to another person. That person will then assume the same entitlements as the deceased person did depending on the class of shares and rights attached to them.

Relevant LegislationCORPORATIONS ACT 2001 (Cth) Section 1072A (Austl.) (accessed 4/1/2021)

20.6 Selling or Inheriting Deceased Estate Shares on Death

20.6.2 Publically Listed Shares

20.6.2.1 Overview

20.6.2.2 Key Concepts & Terminology

20.6.2.3 Ownership Identification

20.6.2.4 Key Considerations

20.6.2.5 Step-by-Step Process

20.6.2.6 Common Share Registries in Australia

20.6.2.7 Common Brokers in Australia

20.6.1 Private Business Shares

If the Beneficiaries of the Deceased Estate do not want to own part of the business, the shares may be sold to the other owners and directors or to a member of the public. It will be important to review the constitution or partnership agreement to find out who the shares can be offered to for sale and in what order (first right of refusal).

The Australian Taxation Office (ATO) describes how to value shares of a company.

20.6.2 Publically Listed Shares

Where the deceased person held shares of a public company listed on a stock exchange, like the Australian Stock Exchange (ASX) or overseas exchanges, the shares may be transferred or sold.

20.6.2.1 Overview

When a deceased person owns shares, these need to be dealt with by the Executor or Administrator as outlined below.

It is important to understand some overarching concepts and terminology used when dealing with shares, be that for transferring or selling shares.

simplyEstate users benefit from Australia's lowest share sale fees with our trusted broker One Off Trades. From only $135 or 1.35%, whichever is higher, +GST.No Hidden Fees Guaranteed.

20.6.2.2 Key Concepts & Terminology

CHESSThe Clearing House Electronic Subregister System (CHESS) is the ASX's electronic system and register to record ownership and transfers of shares. The CHESS will record all shareholdings based on the shareholder's identification number (explained below).

Share RegistriesWhen a company, like Telstra, lists their shares on a public stock exchange, such as the Australian Stock Exchange (ASX), a share registry manages the administration of all issued shares on Telstra's behalf, including Telstra shares of a Deceased Estate. Five major registries operate in Australia, whose contact details we have put together for your convenience below.

StockbrokersRegistries will be able to manage transfers and/or registration details (i.e. who owns the shares), but will not be able to sell shares, which is where stockbrokers come in. brokers facilitate the selling and buying of shares and the deceased person likely used a broker to buy the shares originally. We will guide you through the steps of selling Deceased Estate shares step-by-step in the following sections.

20.6.2.3 Ownership Identification

Shares can be held in two different ways, one being directly with the share registry and the other being via a broker, which will determine how you transfer and/or sell the deceased person's shares.

The deceased person will have a unique identification number issued by the ASX, called a Securityholder Reference Number (SRN) or a Holder Identification Number (HIN). These numbers help identify the ownership when transferring or selling shares.

What's the difference between SRN and HIN?- The SRN is used to identify the owner of shares held by a share registry. A shareholder holding shares in multiple companies will have multiple SRNs, one for each company shares are held in. This type of shareholding is also called issuer-sponsored, meaning the shares are held directly by the shareholder with share registry. The SRN either starts with an X or an I (Issuer Sponsored) followed by a ten-digit number (may vary in length).

- The HIN is used to identify a CHESS sponsored shareholder for shares owned through a broker. Unlike with the SRN, a shareholder will have a HIN with a broker and can hold multiple company's shares with the same HIN. This type of shareholding is also called broker-sponsored, meaning the shares are held on the owner's behalf by the broker. The HIN is a unique ten-digit number.

The HIN or SRN can be found on the holding or dividend statements, or can be provided by the broker or share registry respectively.

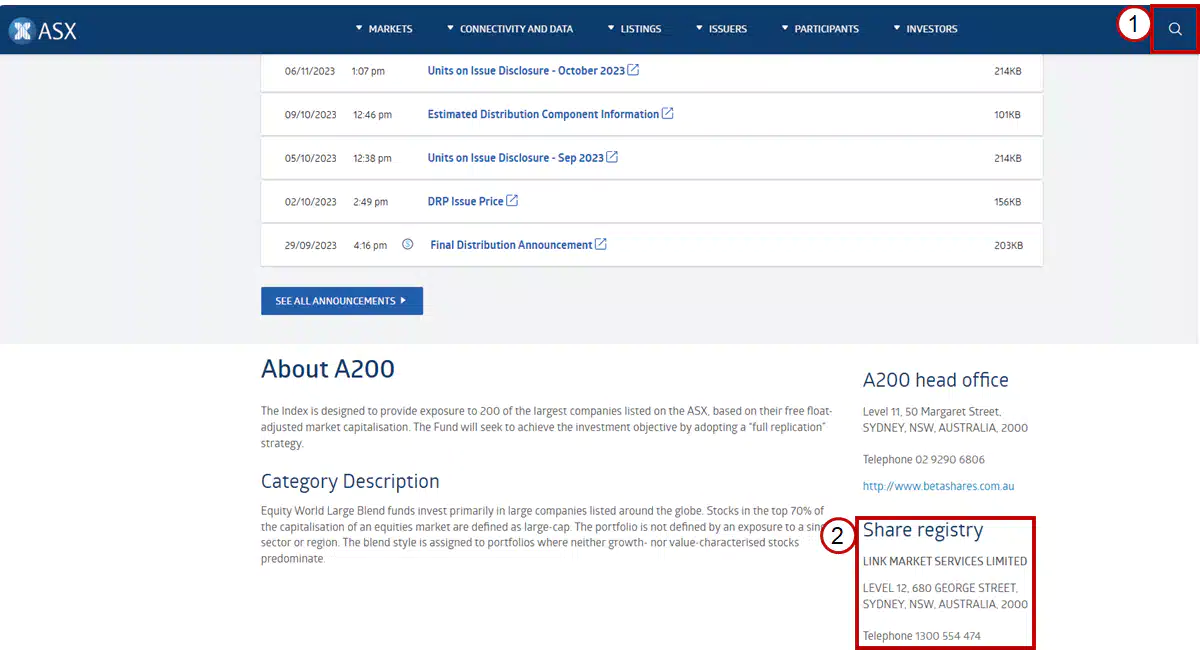

How do you find out which registry, such as computershare, manages the Deceased Estate shares? To find out which share registry manages the shares held, the specific company in which shares are held can be searched on the Australian Stock Exchange (ASX) website and the 'Share registry' section looked up as shown in the image below.

20.6.2.4 Key Considerations

- Shares, like other assets, can be held solely by only one person or jointly by multiple persons. The type of ownership will determine what can be done with the shares and if they form part of the Estate or not. This is explained in more detail in the next section below.

- Unless specified in the valid Will (where available), the Executor or Administrator should also consider whether the shares should be sold or if they should be transferred to one or multiple Beneficiaries. Distribution of cash after selling shares is generally simpler as it can be divided and doesn't fluctuate in value on a daily basis, however the Executor/Administrator and Beneficiaries may agree to keep the shares.

- Generally speaking, shares should be transferred to the Estate or the Executor's/Administrator's name while in their custody. This ensures distributions in forms of dividends or interest are paid to the Estate, which need to be recorded as income and need to be declared as income tax. Shares oftentimes can only be sold or transferred to Beneficiaries if the shares are held by the Estate.

- Tax implications should also be considered when dealing with a deceased person's shares. Capital Gains Taxes generally don't apply to the Estate when shares are sold but may apply if shares are transferred to a Beneficiary or organisation, or if the Beneficiary sells the inherited shares at a later date.

20.6.2.5 Step-by-Step Process

OverviewSolely Held Shares – Transfer to Estate for Sale or Transfer to Beneficiaries

Jointly Held Shares – Transfer to Surviving Joint Owner

Overview

If you, as the Executor or Administrator, have found out that the deceased person owned shares, look for statements and/or communication from the Australian Stock Exchange (ASX) or one of the share registries.

It is then important to determine how the shares were owned: The statements should indicate if shares are owned solely (only in the deceased person's name) or jointly (with another person) if the addressee is a single name or are multiple names. If shares are owned jointly, they will transfer to the surviving joint owner and don't form part of the Estate (see details below).

Solely Held Shares – Transfer to Estate for Sale or Transfer to Beneficiaries- Finding out which share registry or broker process needs to be followed.

- If the statement for a specific shareholding shows an SRN, you can generally complete a Deceased Estate share transfer to the Estate directly with the relevant share registry using the following form (also referred to as Transmission Application).

- Advanced share registry: Now Automic

- Automic: Transmission Application Form

- Boardroom: Transmission Application Form

- Computershare Deceased Estate: Transmission Application – Transmit Securities to Executor(s)/Administrator(s)

- Link Market Services: Transmission Application Form

- If the statement shows a HIN, the sponsoring broker should be able to transfer the shares to the Estate.

Note: Grant of Probate or Letters of Administration [link to Step 27] (discussed in Step 27) will be required to complete this process. Where probate will not be applied for due to the small size of the Estate, a Small Estates Indemnity form may suffice to request transfer.

- If the statement for a specific shareholding shows an SRN, you can generally complete a Deceased Estate share transfer to the Estate directly with the relevant share registry using the following form (also referred to as Transmission Application).

- Keeping track of the shares and record any proceeds in form of dividend and/or interest payments for reporting and tax purposes once the shares were transferred to the Estate.

- Selling shares if cash is to be distributed to Beneficiaries:

- Where a shareholding is linked to a HIN, we recommend you contact the sponsoring broker to sell the shares.

- If the statement for a specific shareholding shows an SRN, our trusted broker One Off Trades can facilitate the share sale on the Estate's behalf for a small fee.

simplyEstate users benefit from Australia's lowest share sale fees from only $135 or 1.35%, whichever is higher, +GST.

No Hidden Fees Guaranteed.

- Transferring shares from a Deceased Estate to Beneficiaries if this was decided to be the best approach:

- If the statement for a specific shareholding shows an SRN, you can generally transfer the shares to the Beneficiary directly with the relevant share registry.

- Advanced share registry: Now Automic

- Automic: Standard Transfer Form

- Boardroom: Australian Standard Transfer Form

- Computershare: Standard Transfer – Transfer Securities to Beneficiary(s)/Buyer(s)

- Link Market Services: Deceased Estate Standard Transfer Form

- If the statement shows a HIN, a broker-to-broker transfer can be requested for a small fee (also called off-market transfer) to facilitiate transferring shares from a Deceased Estate.

- If the statement for a specific shareholding shows an SRN, you can generally transfer the shares to the Beneficiary directly with the relevant share registry.

- Determine how shares were owned: The statements should indicate if shares are owned solely (only in the deceased person's name) or jointly (with another person) if the addressee is a single name or are multiple names. If shares are owned jointly, they will transfer to the surviving joint owner and don't form part of the Estate. See section below.

- Decide if the Surviving Joint Owner would like to sell or keep the shares.

- If shares are to be sold, then our trusted broker One Off Trades can assist with the transfer and sale in accordance with survivorship rules.

simplyEstate users benefit from Australia's lowest share transfer and sale fees from only $135 or 1.35%, whichever is higher, +GST.

No Hidden Fees Guaranteed. - If shares are only to be transferred without selling, find out which share registry or broker process needs to be followed.

- If the statement for a specific shareholding shows an SRN, the shares can generally be transferred to the surviving joint owner directly by the relevant share registry by completing and posting the relevant form and supporting documents.

- Advanced share registry: Now Automic

- Automic: Request to Register Surviving Holders Form

- Boardroom: Request to Register Surviving Holders – Deceased Estate

- Computershare: Request to Register Surviving Securityholder(s)

- Link Market Services: Request for Transmission (Surviving Joint Holder)

- If the statement shows a HIN, the broker should be able to transfer the shares to the surviving joint owner.

- If the statement for a specific shareholding shows an SRN, the shares can generally be transferred to the surviving joint owner directly by the relevant share registry by completing and posting the relevant form and supporting documents.

20.6.2.6 Common Share Registries in Australia

Advanced Share Registry (now Automic)Automic Group (acquired Security Transfer Australia and Advanced Share Registry)

Website: www.automicgroup.com.au

Email: hello@automicgroup.com.au

Phone: 1300 288 664 or +61 (0)2 9698 5414 from overseas

Boardroom P/L (formerly Registries)

Website: www.boardroomlimited.com.au

Email: enquiries@boardroomlimited.com.au

Phone: 1300 737 760 or +61 (0)2 9290 9600 from overseas

Computershare Services

Website: www.computershare.com.au

Email: Online Enquiry Form

Phone: 1300 850 505 or +61 (0)3 9415 4000 from overseas

Link Market Services

Website: www.linkmarketservices.com.au

Email: registrars@linkmarketservices.com.au

Phone: 1300 554 474

20.6.2.7 Common Brokers in Australia

- CommSec (Commonwealth Bank)

- Westpac Share Trading

- nabtrade (NAB)

- ANZ Share Investing

- HSBC Share Trading

- CMC Markets Invest

- IG Share Trading

- Selfwealth

- eToro

No Hidden Fees Guaranteed.

20.7 Closing the Business

If the Beneficiaries of the Deceased Estate have already decided to close the business, then either the process of winding up the company or a sale process may be started.

You can wind-up and deregister a company voluntarily by following the below process:

Australian Securities and Investments Commission (ASIC)

Post: Australian Securities and Investments Commission, PO Box 4000, Gippsland Mail Centre VIC 3841You can wind-up and deregister a company:

- Online; or

- by Post by completing and submitting the below forms.

- Form 520 – Declaration of solvency; and

- Form 6010 – Application for voluntary deregistration of a company.

- CORPORATIONS ACT 2001 (Cth) Section 494 (Austl.) (accessed 4/1/2021)

- CORPORATIONS ACT 2001 (Cth) Section 601AA (Austl.) (accessed 4/1/2021)

Read Further

You are currently on Step 20 – Dealing With Businesses, Trusts & Shares After a Death. Other steps of interest may be:

> Step 15 – Determining Deceased Estate Assets & the Residuary Estate > Step 29 – Opening a Testamentary Trust per the Will > Blog – Selling Deceased Estate SharesComplete Step

Actions and Decisions to Complete Step Yourself

If you have decided to complete this Step yourself, some actions and decisions may be to:

- Determine if the deceased person was a sole trader, owner, partner or shareholder of a company or partnership (see Step 20.1 above);

- Establish if the deceased person held director (or equivalent) or board positions and inform the necessary persons to ensure duties are taken on by the best placed person (see Step 20.2 above);

- Check the relevant constitution, partnership agreement, by-laws or other types of contract and rules to determine the procedures after a death (see Step 20.3 above);

- Determine what Assets and Liabilities may form part of the Estate (see Step 20.4 above);

- Appoint the Executor or Administrator as the interim director (or equivalent) to continue business operations (if applicable) (see Step 20.5 above);

- Identify shareholdings and transfer these to the Estate, to then sell or transfer to Beneficiaries (see Step 20.6 above);

- Check the Will (if available) about any specific instructions about how the business (or equivalent) are to be managed after the death;

- Discuss and agree with the Beneficiaries if the business (or equivalent) will be sold, closed or handed over (see Step 20.6 or Step 20.7 above);

- Transfer the signing authority the deceased person had (if applicable) (see Step 20.2 above); and

- Update the Assets & Liabilities Inventory with all shares and company assets that belong to the deceased person (download the simplyEstate Assets & Liabilities Inventory).

Click for supporting:

Information

Forms

Legislation

Cost & Effort

Reading: 20 mins

Completing: 1-3 hrs

Total: 1:20-3:20 hrs

Cost: $0

Effort and cost are general estimates only and are based on the assumption that you complete this step without experienced support.

Instructions

To find out how this Process Guide works, access the instructions here.

Glossary

To find out what the capitalised words mean, access the glossary here.

Forms

Close Business with ASIC

Form 520 – Declaration of solvencyForm 6010 – Application for voluntary deregistration of a company

Refer to Step 20.7 above for more detail about these forms.

Other forms not listed here may be required based on your specific circumstances.

Checklists & Tools

Download Australia's smartest Assets & Liabilities Inventory to automatically calculate the total Estate value based on ownership for probate.Legislation & Rules

No Partnership Agreement in WA

PARTNERSHIP ACT 1895 (WA) Section 44 (Austl.)Appoint New Director in WA

CORPORATIONS ACT 2001 (Cth) Section 201F (Austl.) (accessed 4/1/2021)Transfer of Shares in WA

CORPORATIONS ACT 2001 (Cth) Section 1072A (Austl.) (accessed 4/1/2021)Close Business in WA

CORPORATIONS ACT 2001 (Cth) Section 494 (Austl.) (accessed 4/1/2021)CORPORATIONS ACT 2001 (Cth) Section 601AA (Austl.) (accessed 4/1/2021)

No Partnership Agreement in NSW

PARTNERSHIP ACT 1892 (NSW) Section 33 (Austl.) (accessed 4/1/2021)Appoint New Director in NSW

CORPORATIONS ACT 2001 (Cth) Section 201F (Austl.) (accessed 4/1/2021)Transfer of Shares in NSW

CORPORATIONS ACT 2001 (Cth) Section 1072A (Austl.) (accessed 4/1/2021)Close Business in NSW

CORPORATIONS ACT 2001 (Cth) Section 494 (Austl.) (accessed 4/1/2021)CORPORATIONS ACT 2001 (Cth) Section 601AA (Austl.) (accessed 4/1/2021)

No Partnership Agreement in VIC

PARTNERSHIP ACT 1958 (VIC) Section 37 (Austl.) (accessed 4/1/2021)Appoint New Director in VIC

CORPORATIONS ACT 2001 (Cth) Section 201F (Austl.) (accessed 4/1/2021)Transfer of Shares in VIC

CORPORATIONS ACT 2001 (Cth) Section 1072A (Austl.) (accessed 4/1/2021)Close Business in VIC

CORPORATIONS ACT 2001 (Cth) Section 494 (Austl.) (accessed 4/1/2021)CORPORATIONS ACT 2001 (Cth) Section 601AA (Austl.) (accessed 4/1/2021)

No Partnership Agreement in QLD

PARTNERSHIP ACT 1891 (QLD) Section 36 (Austl.) (accessed 4/1/2021)Appoint New Director in QLD

CORPORATIONS ACT 2001 (Cth) Section 201F (Austl.) (accessed 4/1/2021)Transfer of Shares in QLD

CORPORATIONS ACT 2001 (Cth) Section 1072A (Austl.) (accessed 4/1/2021)Close Business in QLD

CORPORATIONS ACT 2001 (Cth) Section 494 (Austl.) (accessed 4/1/2021)CORPORATIONS ACT 2001 (Cth) Section 601AA (Austl.) (accessed 4/1/2021)

Other legislation and rules not listed here may apply to your specific circumstances.

Guidance & Support

Executor Checklists & Tools

Trusted Support

Have you encountered a challenge needing professional support, or are you unsure about how to proceed? Find out about our support options and personal guidance to get you back on your way with confidence.

Executor & Administrator Support WA

We can help with:- discussing the businesses and shares

- assessing your situation and approach

- engaging an Estate & Probate Lawyer or Broker

Review our services and book a free phone appointment.

Find Out More

Estate & Probate Lawyer WA

Our trusted partner can help with:- reviewing partnership and shareholder agreements

- dealing with a business in probate and draft sale contract

- administering the Estate end-to-end

Estate Share Broker WA

Our trusted partner can help with:- selling SRN shareholdings held by the Estate

- selling SRN and HIN shareholdings on behalf of the surviving joint owner

No Hidden Fees Guaranteed.

Find Out More

Executor & Administrator Support NSW

We can help with:- discussing the businesses and shares

- assessing your situation and approach

- engaging an Estate & Probate Lawyer or Broker

Review our services and book a free phone appointment.

Find Out More

Estate & Probate Lawyer NSW

Our trusted partner can help with:- reviewing partnership and shareholder agreements

- dealing with a business in probate and draft sale contract

- administering the Estate end-to-end

Estate Share Broker NSW

Our trusted partner can help with:- selling SRN shareholdings held by the Estate

- selling SRN and HIN shareholdings on behalf of the surviving joint owner

No Hidden Fees Guaranteed.

Find Out More

Executor & Administrator Support VIC

We can help with:- discussing the businesses and shares

- assessing your situation and approach

- engaging an Estate & Probate Lawyer or Broker

Review our services and book a free phone appointment.

Find Out More

Estate & Probate Lawyer VIC

Our trusted partner can help with:- reviewing partnership and shareholder agreements

- dealing with a business in probate and draft sale contract

- administering the Estate end-to-end

Request an obligation free phone call to discuss your situation.

Find Out More

Estate Share Broker VIC

Our trusted partner can help with:- selling SRN shareholdings held by the Estate

- selling SRN and HIN shareholdings on behalf of the surviving joint owner

No Hidden Fees Guaranteed.

Find Out More

Executor & Administrator Support QLD

We can help with:- discussing the businesses and shares

- assessing your situation and approach

- engaging an Estate & Probate Lawyer or Broker

Review our services and book a free phone appointment.

Find Out More

Estate & Probate Lawyer QLD

Our trusted partner can help with:- reviewing partnership and shareholder agreements

- dealing with a business in probate and draft sale contract

- administering the Estate end-to-end

Request an obligation free phone call to discuss your situation.

Find Out More

Estate Share Broker QLD

Our trusted partner can help with:- selling SRN shareholdings held by the Estate

- selling SRN and HIN shareholdings on behalf of the surviving joint owner

No Hidden Fees Guaranteed.

Find Out More